The same frequency should be used as determined for state income tax withholding purposes. Earnings Tax WithholdingĮmployer's Quarter-Monthly Payment of Earnings Tax Withheldįorm RD-130M is a payment coupon used to remit earnings taxes withheld on a monthly basis. Magnetic Media and Electronic Filing Specificationsįorm RD-130QM is a payment coupon used to remit earnings taxes withheld on a quarter-monthly basis.

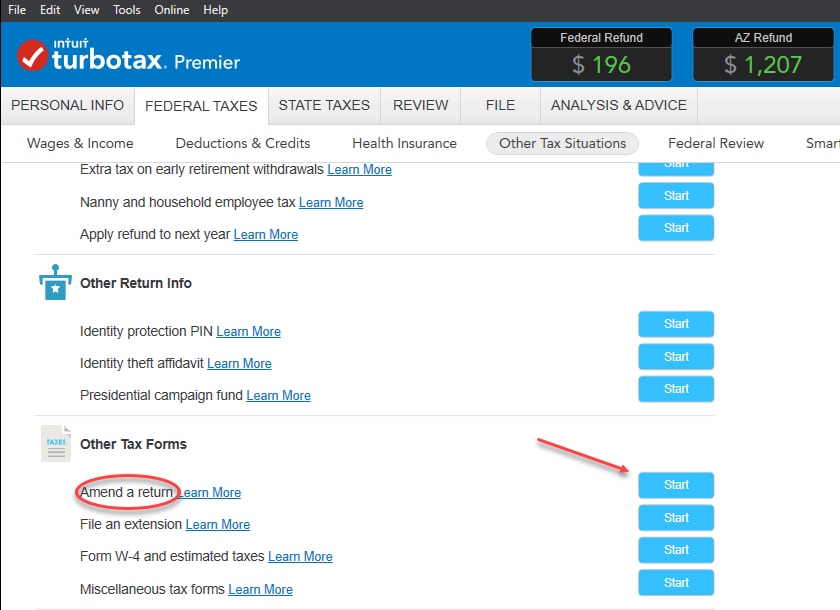

#Turbotax 2017 tax return how to#

See a list of FAQs for more information on how to file Form RD-113 electronically through the bulk filing program.Įmployer's Annual Reconciliation of Earnings Tax Withheld W-2 information should only be provided for employees who had earnings tax withheld from their compensation.

W-2 information is also required to be submitted with Form RD-113. Earnings Tax WithholdingĮmployer's Quarterly Return of Earnings Withheldįorm RD-113 is a reconciliation of annual withholdings to payments remitted. See a list of FAQs for more information on how to file Form RD-110 electronically through the bulk filing program. Form RD-110 is required even if there was no withholding during the quarter. Payments can be made with Form RD-110 for amounts due but not previously paid through weekly or monthly remittances.įorm RD-110 can also be used by employers that are voluntarily withholding on behalf of residents. The gross compensation paid to employees who work or perform services in Kansas City, Missouri should be reported. Included in this requirement are the Employer’s Quarterly Return of Earnings Withheld (Form RD-110), the Employer’s Annual Reconciliation of Earnings Tax Withheld (Form RD-113), and submission of W2 records.įorm RD-110 is a quarterly tax return used by employers. Failure to file electronically may result in filing penalties. Wage Earner Return Earning Tax Nonresident Scheduleīeginning January 1, 2021, all withholding returns must be filed electronically. to determine earnings attributable to their period of residency. Form RD-109NR is also used by a part-year resident of Kansas City, Mo. The number of days worked out of the City must be verified by the employer. to request a refund of tax withheld based on the fact that the employee had whole days worked out of the City. Individual Earnings TaxĮxtension - Wage Earner Return Earnings Taxįorm RD-109NR is a schedule used by a non-resident of Kansas City, Mo. Form RD-109 is also used by a resident to request a refund if over withheld. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer’s employer. Tax Guide for Hair Salons and Barbershopsįorm RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one percent.Financial Information, Reports and Policies.Submitted and Adopted Citywide Business Plan.

0 kommentar(er)

0 kommentar(er)